HOW TO CHOOSE A FOREX ROBOT (EXPERT ADVISOR)

Forex robots (EA) have become very popular ever since the MetaTrader 4 trading platform was released. The many commercial EA offers and frequent scams do not make it any easier to find a robot that genuinely works well.To find an EA that fits your trading style and risk tolerance, you need to analyse various statistics such as maximium loss (drawdown), profit ratios and the risk-to-reward ratio.

Forex trading is very risky, you can lose all of your money even with a robot that displays good statistics. Before using an expert advisor with a real trading account, you need to know in advance the financial risk that you can afford to take. The most profitable robots are usually also the most risky ones. So you also should choose a robot based on your appetite for risk.

Before you invest your money, it is essential that you test the robot with a demo account and do backtests on historical market data. Choose an STP forex broker that allows you to trade micro lots in order to start real trading with minimum risk and also to see if the EA works well with that broker.

Analysing an Expert Advisor's stats

1) The Profit Factor

The profit factor is one of the most important statistics. It allows you to answer an important question: will the robot make money?

The profit factor is important because it shows the relationship between profit and risk. A robot that is profitable - but nevertheless risks all of the money in your account - is not an ideal robot.

To calculate the profit factor:

Profit Factor = gross profit (sum of all winning trades) / gross loss (sum of all losing trades)

If the profit factor is less than 1, you must eliminate it immediately, choose EAs with a big profit factor.

2) Expected profit per transaction (Expectancy)

The expected profit (Expectancy) is a statistic that tells you how much you could earn on each trade on average.

Obviously, these statistics are based on trading history, so it doesn't guarantee future results, but it is a useful indicator when choosing an EA.

The expected profit is calculated as follows:

Expected profit = [% of winning trades (average profit per trade)] - [% of losing trades (average loss per trade)]

3) The drawdown (max drawdown, average drawdown, drawdown recovery)

A robot that makes money is no good if it takes too much risk on each trade. Drawdown is a very important indicator of risk. It shows the percentage of maximum loss recorded since the last high point. This can give you an idea of the potential drop in your account when the robot is in trouble.

The first step to analyse drawdown is to look at an equity curve chart. A rising curve indicates that the robot is profitable, but if the curve is rather agitated with frequent and large peaks and troughs, the robot is very volatile. A volatile robot will most likely have a high drawdown and pose a greater risk. You can therefore quickly filter the robots by selecting charts that display a smooth equity curve.

Maximum drawdown simply shows the maximum loss since the last high point. For example, a 50% drawdown means that at some point the robot lost 50% of the account value from its highest point. For example, if you opened a trading account with £10,000 and started to use this EA at the wrong time (just before the drawdown), you would have been subjected to a 50% loss of your capital from the start!

The average drawdown compares the EA's various drawdown amounts. For example, let's say that the expert advisor had 3 drawdowns, the first 10%, the second 4% and the third 12%. To calculate the average drawdown, you just need to add the three drawdowns and divide by three (10% + 4% + 12%) / 3 = 8.7%. The average drawdown is interesting to look at because it gives you an idea of what you can expect to lose during a drawdown period, while the maximum drawdown showed you the worst case.

Drawdown recovery is an indicator that measures the speed with which a trading system emerges from a period of drawdown (in time or in number of trades). As you can imagine, it is best to choose an EA that is able to quickly return to positive territory after a loss. However, a less volatile (and less risky) robot will recover from a drawdown in a slow and steady manner, unlike a riskier robot.

4) The risk-reward ratio

The risk-reward ratio indicates an Expert Advisor appetite for risk. An Expert Advisor that uses a 5-pip take profit and a 40-pip stop loss has a risk-reward ratio of 8:1. It therefore needs a success rate of at least 89% to be profitable.

Some EAs on the market - especially the ones that scalp - have a risk-reward ratio of 15:1 and higher, which indicates that it uses a very risky strategy. A high risk-reward ratio does not necessarily mean that the EA does not make money. An Expert Advisor with a 95% success rate will still be profitable with a 15:1 risk-reward ratio, but if that rate drops to 93%, the EA will lose.

Most EAs feature options that allow you to manage risk by adjusting the maximum SL and TP, which allows you to improve the risk-reward ratio. However, you need to make backtests before changing the settings to see if the changes do not affect the strategy.

LAST BUT NOT LEAST

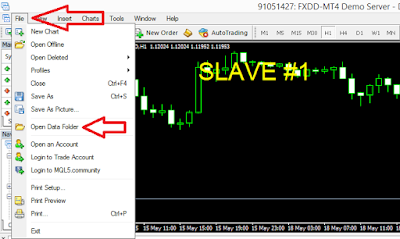

MT5 FX ROBOT give you the best experience in using Forex Robot. MT5 FX ROBOT has a lot of uniqueness that you can not find it in others Forex Robot.

MT5 FX ROBOT has numerous advantages as :

- You can verify the results by login into the trading terminal used for MT5 FX ROBOT with the investor password feature

- Programmed by experienced and well known forex robot coders.

- All the trading algorithms are following how an actual trader trades. His daily profits have been ranging from $10K to $100K every single day.

- Provides quality and different customer support options like e-mail, live chat support and skype.

- You do not need any trading experience. However it is advisable that you must have basic trading knowledge on money/risk management if you wish to change those settings.